34+ Mortgage calculator purchase price

The free mortgage calculator is a versatile tool as useful to an individual casually researching properties as it is to someone on the cusp of making a purchase. Youll need to save around 217 of the purchase price.

Home Buyers Closing Cost Calculator Mls Mortgage Closing Costs Mortgage Home Loans

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages.

. A chattel mortgage is when a financier loans money to you for the purchase of a vehicle. Average closing cost is 3-5 of the homes price. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

A reverse mortgage is a mortgage. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. Call us FREE on.

Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Across the United States 88 of home buyers finance their purchases with a mortgage.

Use our commercial mortgage calculator to calculate business finance monthly repayments and interest costs for different mortgage terms and interest rates. Provides mortgage insurance on loans made by FHA-approved lenders throughout the United States and its territories. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

A chattel mortgage calculator comes up with a repayment amount based. Estimate your monthly payment with our Mortgage Calculator. 5 down Down Payment in Dollars.

Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Down Payment The cash put toward the purchase of a home to make up the difference between the purchase price and the mortgage loan - usually a percent of the purchase price ie. Across the United States 88 of home buyers finance their purchases with a mortgage.

In 2000 the Census Bureau estimated that 34 million of the countrys 270 million residents were sixty-five years of age or older while projecting the two. It is the largest insurer of mortgages in the world insuring over 34 million properties since its inception in 1934. Assuming you have a 20 down payment 24000 your total mortgage on a 120000 home would be 96000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 431 monthly payment.

Fortunately Texas is one of the few states that doesnt levy transfer taxes or include a state recordation tax which will save you. Since you dont have any trading history to demonstrate your. 534 pa.

FHA insures mortgages on single-family multifamily and manufactured homes and hospitals. No private mortgage insurance. Assuming you have a 20 down payment 100000 your total mortgage on a 500000 home would be 400000.

This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate. The HECM for Purchase applies if the borrower is able to pay the difference between the HECM and the sales price and closing costs for the. Lets take a moment to go through the various moving parts of the home loan calculator to get a better understanding of what future mortgage payments might be by providing.

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. This is likely to happen as holders of higher-coupon mortgages can.

If the purchase price was 105 the investor loses 5 cents for every dollar prepaid which may significantly decrease the yield. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1796 monthly payment. This is possible with a higher deposit usually of around 50 of the purchase price.

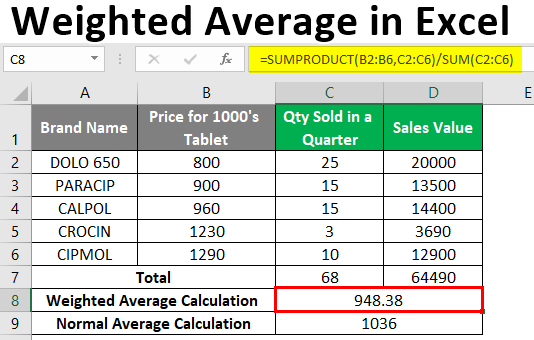

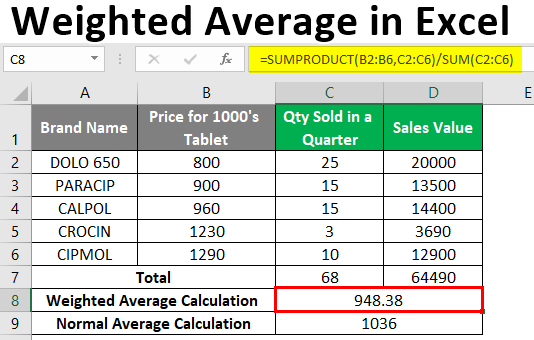

Weighted Average In Excel How To Calculate Weighted Average In Excel

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Buying Your First Home

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Louisville Kentuc Mortgage Loan Originator Va Loan Home Loans

Designing The Perfect Slider Smashing Magazine Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Mortgage Calculator By Digital Designer Calculator Design Mortgage Calculator Mortgage

How Much House Can I Afford Insider Tips And Home Affordability Calculator Personal Budget Mortgage Canning

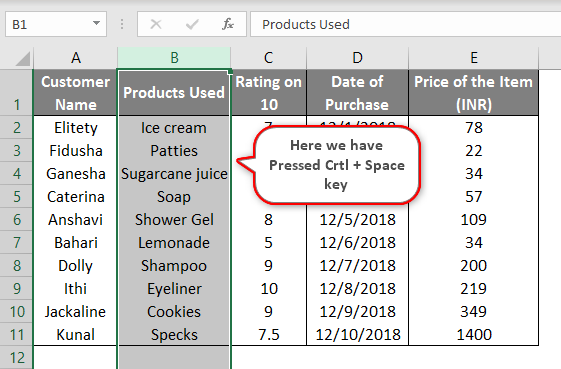

Switching Columns In Excel How To Switch Columns In Excel

Can I Calculate Mortgage Payments With Online Tools Ask Dave Taylor In 2022 Mortgage Payment Mortgage Payment Calculator Mortgage

15 Year Vs 30 Year Mortgage 30 Year Mortgage Money Management Mortgage Payment

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Home Affordability Calculator Mortgage Amortization Calculator Mortgage Quotes Free Mortgage Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

How Much House Can I Afford Insider Tips And Home Affordability Calculator Home Buying Process Buying First Home Home Buying Tips

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Down Payment Calculator Buying A House Mls Mortgage Free Mortgage Calculator Mortgage Payment Calculator House Down Payment

What You Need To Know About The Mortgage Process Infographic Mortgage Process Mortgage Infographic Real Estate Infographic