29+ Principal amount amortization

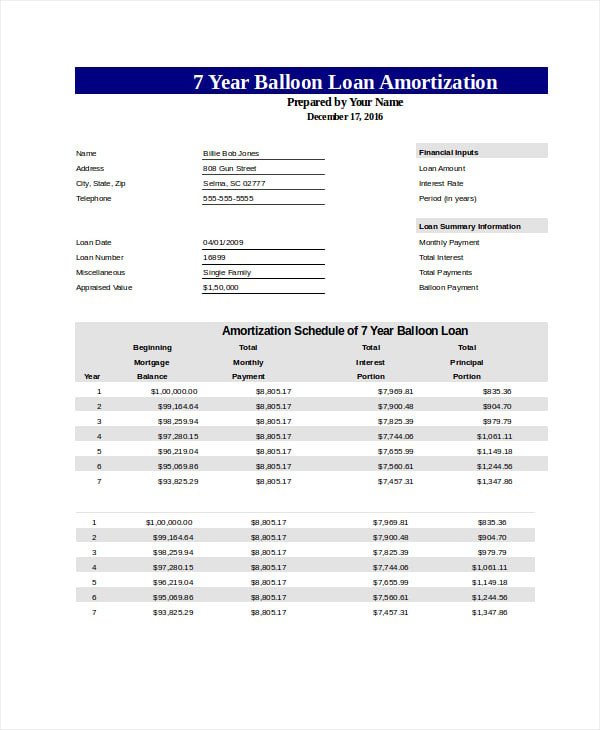

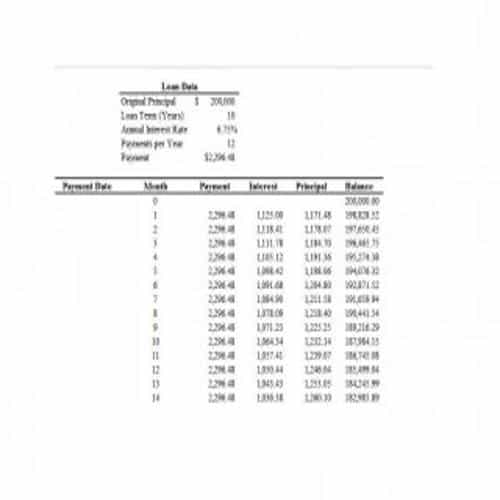

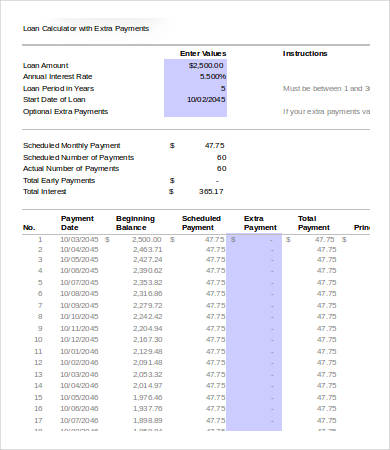

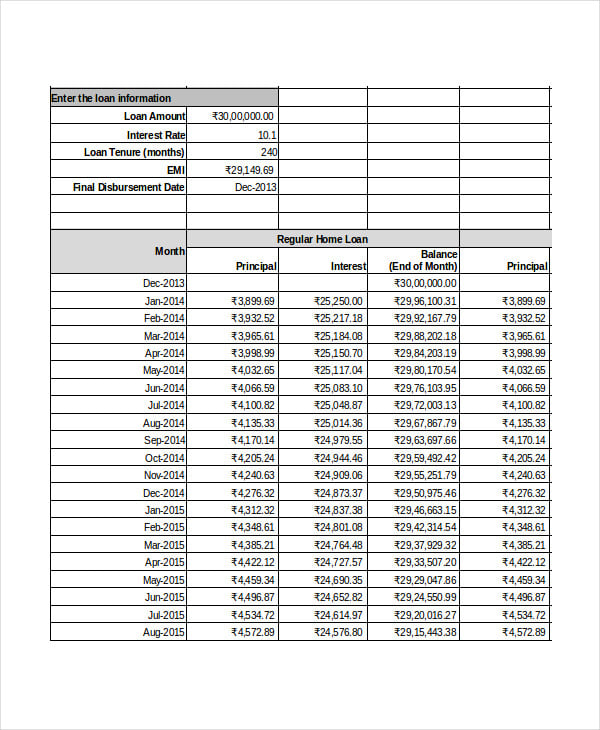

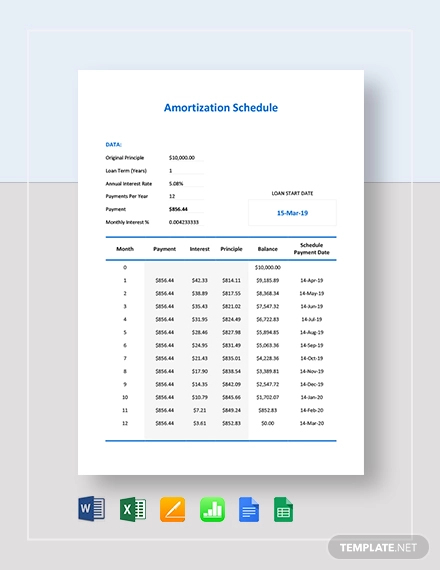

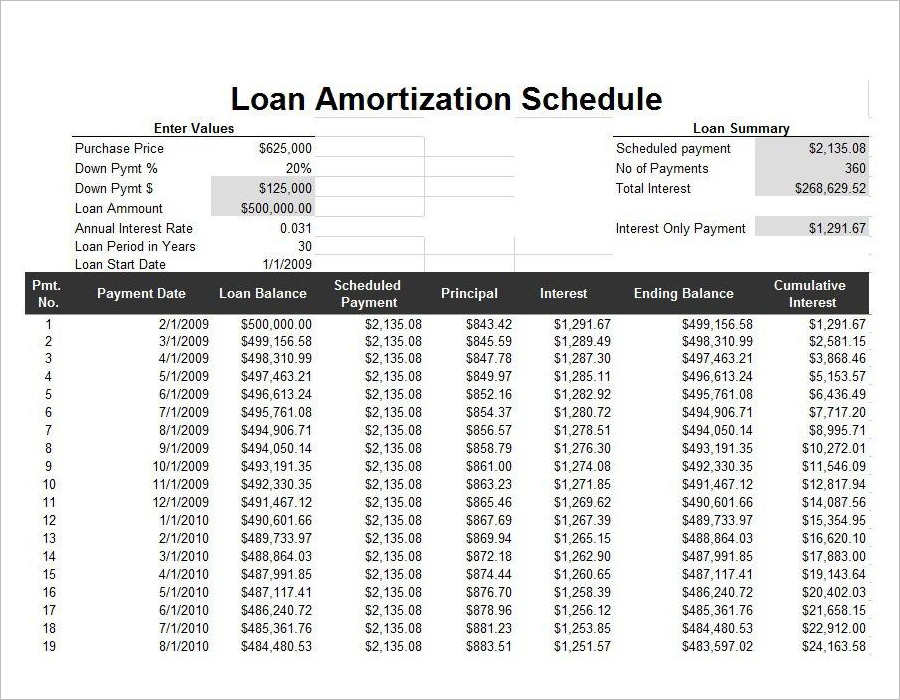

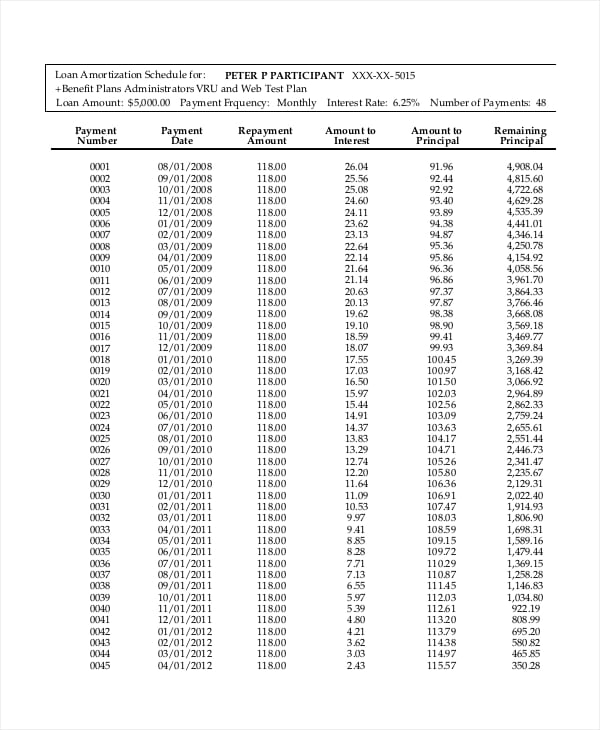

Loan amount Optional extra payments Scheduled payment Scheduled number of payments. Loan payments consist of two parts.

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

The mortgage amortization period is how long it will take you to pay off your mortgage.

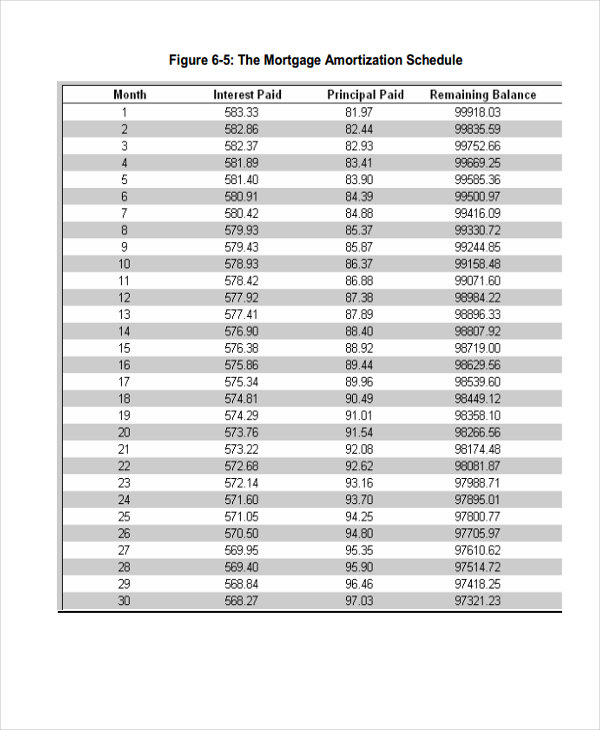

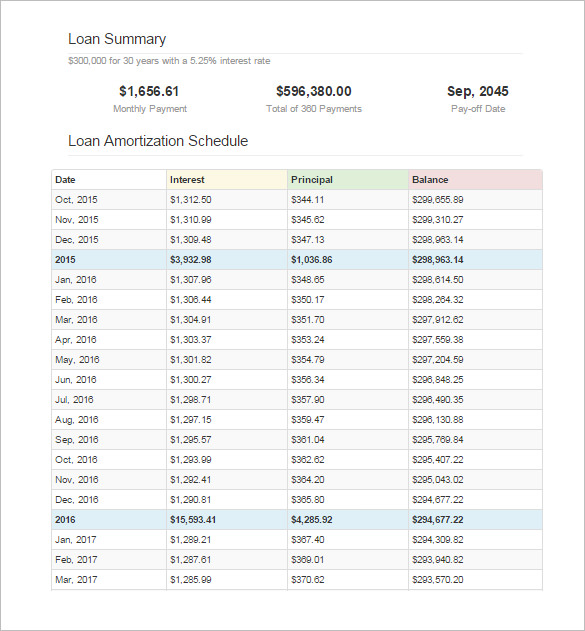

. If the compound period is shorter than the payment period using this formula results in negative amortization paying interest on interest. Here we are going to build out an amortization schedule for a loan and its going to be one of those exercises like in high school where your teacher made you do it by hand yet the entire time you were probably thinking this would be much easier with a calculator. The mortgage amortization schedule shows how much in principal and interest is paid over time.

The principal is the amount borrowed while the interest is the lenders charge to borrow the money. If the nominal annual interest rate is i 75 and the interest is compounded semi-annually n 2 and payments are made monthly p 12 then the rate per period will be r 06155. Loan Balance 15 Years.

When you change any input this calculator will automatically compute a loans payment amount based on the principal amount borrowed the length of the loan and the annual interest rate. An amortized bond is a bond with the principal amount otherwise known as face value regularly paid down over the life of the bond. The most common mortgage term in Canada is five years while the most common amortization period.

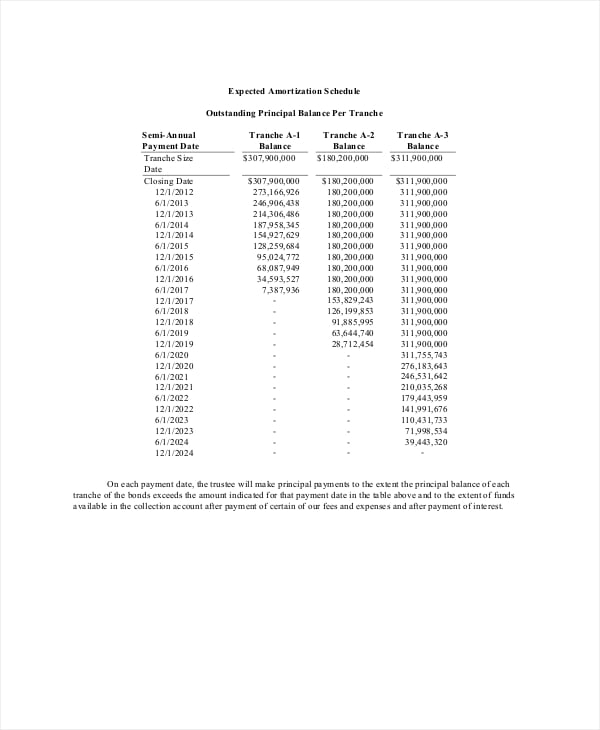

There are two methods through which amortization calculations are commonly performed straight-line and effective-interest. 29 44159 18991546492219451 10736432460242781 100 11736432460242781. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for.

By the time of the last payment 30 years later the breakdown would be 369 for principal. Loan Balance 10 Years. The loan will begin on March 1 and the entire 4 million of principal will be due five years later.

In addition to the one-time loan costs of 120000 the company will also have the cost of the borrowed money which is 360000 4 million X 9 of interest each year for five years. With a ceiling of 150 that amount in areas where median home values are higher. Click on the Create Amortization Schedule button to create an amortization report you can print out.

For example after exactly 30 years or 360 monthly payments youll pay off a 30-year mortgage. It also refers to the spreading out. Below is the monthly mortgage insurance premium MIP calculation with examples and pseudocode using the annual and upfront MIP rates in effect for mortgages assigned an FHA case number before October 4 2010.

It also displays a mortgage amortization table detailing the principal and interest paid each month. The limit is as follows for 2 3 and 4-unit homes 828700. The formula for calculating monthly mortgage insurance premium became effective May 1 1998 see Mortgagee Letter 98-22 Attachment.

The increased amount of lending led among other factors to the United States housing bubble of 2000-2006. Taxes and other expenses wrapped into. Create Monthly Loan Amortization Schedule.

This calculator will compute a loans payment amount at various payment intervals -- based on the principal amount borrowed the length of the loan and the annual interest rate. We welcome your comments about this publication and suggestions for future editions. Your last loan payment will pay off the final amount remaining on your debt.

NW IR-6526 Washington DC 20224. M P i 1 - 1 1 i n where M monthly payment P principal loan amount i interest rate n number of months to pay off the loan For example to calculate the monthly payments for a 30-year fixed mortgage with an. Use for Any Loan Type.

The amortization schedule formula on how to calculate monthly mortgage payments is given below. Around year 28 or 29 the majority of the yearly payments will go. A typical amortization schedule of a mortgage loan will contain both interest and principal.

See how those payments break down over your loan term with our amortization calculator. And how much of that amount is for principal and how much is for interest. Basic amortization schedules do not account for extra payments but this doesnt mean that borrowers cant pay extra towards their loans.

Loan Balance 5 Years. The lender will require you to start paying principal and interest on an amortization schedule or pay off the loan in. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan.

Is a loans principal payment included on the income statement. How to calculate monthly mortgage payments. An amortization schedule helps indicate the specific amount that will be paid towards each along with the interest and principal paid to date and the remaining principal balance after each pay period.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. A typical loan repayment consists of two parts the principal and the interest. The interest charge for the second payment would be 16633 while 20329 will go toward the principal.

P is the principal amount borrowed A is the periodic amortization payment r is the periodic interest rate divided by 100 nominal annual interest rate also divided by 12 in case of monthly installments and n is the total number of payments for a 30-year loan with monthly payments n 30 12 360. PAYMENT DATE BEGINNING BALANCE SCHEDULED PAYMENT EXTRA PAYMENT TOTAL PAYMENT PRINCIPAL INTEREST ENDING BALANCE CUMULATIVE INTEREST Your Bank. Calling for lump payments toward the end of financing.

Monthly Principal Interest. Definition of Loan Principal Payment. This interest charge is typically a percentage of the outstanding principal.

When a company borrows money from its bank the amount received is recorded with a debit to Cash and a credit to a liability account such as Notes Payable or Loans Payable which is reported on the companys balance sheetThe cash received from the bank loan is referred to. The growth of lightly regulated derivative instruments based on mortgage-backed securities such as collateralized debt obligations and credit default swaps is widely reported as a major causative factor behind the 2007 subprime. Payment Calculator with amortization schedule to calculate any type of loan payments.

Payments toward principal and.

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Loan Payment Schedule Template Amortization Schedule Schedule Template Loan Repayment Schedule

Amortization Tables 4 Free Word Excel Pdf Documents Download Free Premium Templates

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

29 Amortization Schedule Templates Free Premium Templates

Loan Amortization Schedule In Excel Amortization Schedule Interest Calculator Excel Tutorials

Loan Payoff Schedule Mortgage Amortization Excel Template Download

Amortization Schedule Template 8 Free Word Excel Documents Download Free Premium Templates

Amortization Tables 4 Free Word Excel Pdf Documents Download Free Premium Templates

Amortization Schedule Template 8 Free Word Excel Documents Download Free Premium Templates

9 Amortization Schedule Calculator Templates Free Excel Pdf

Amortization Schedule Template 13 Free Word Excel Pdf Format Download Free Premium Templates

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator